Outsourcing Implementation

The Definitive CFO Decision Matrix

FINANCE LEADERS TODAY HAVE TWO SHORTAGES THEY’RE CONSTANTLY REQUIRED TO CONTEND WITH: TALENT AND TIME

Scarcity and churn among qualified accounting professionals only serve to compound the overwhelming sense among CFOs and financial leadership that too much of their time is spent on transactional tasks while strategic initiatives are left to languish.

That can turn into a frustrating feedback loop that too often slows potential growth and stalls profit gains. The right outsourcing implementation can provide a way toward gaining a foothold by opening up the talent pool to offshore candidates, streamlining accounting processes and allowing leadership to pivot away from time-consuming data entry and bookkeeping – all while saving companies as much as 50 percent.

Once you’ve decided to outsource some function of your finance and accounting workload, the next step is deciding what to outsource. In some cases, a business may come to realize that they could benefit from finance and accounting outsourcing (FAO) services but face a new challenge: effectively taking stock of where those solutions could most effectively be implemented and how.

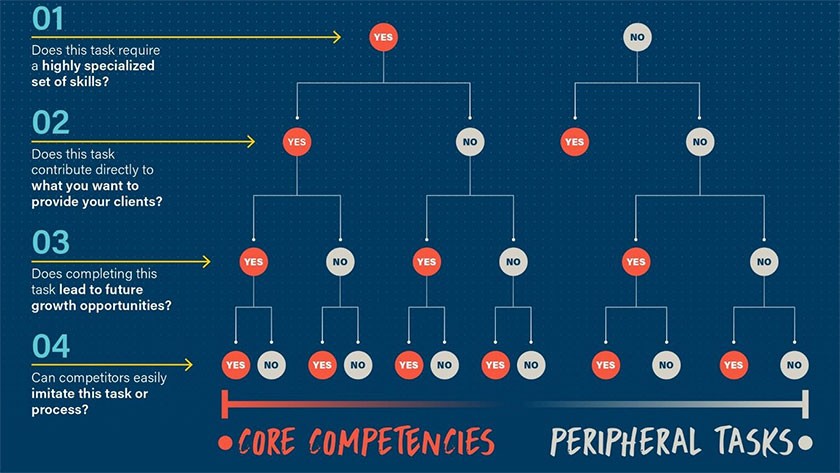

Determining Core Competencies

The first step along the way is to determine what not to outsource. Every company has a set of core competencies or business-critical tasks at its center. Outsourcing is designed to buttress to these competencies, so knowing your business-critical goes a long way toward deciding what to outsource and what to keep in-house.

Use this chart to determine whether something is core to your company’s continued ability to do business and grow, or if they’re peripheral to those goals. Competencies and tasks that are peripheral are great candidates for outsourcing.

For example, look at the process of reconciling accounts at the end of the month. It does require a specific skillset, but it likely does not contribute heavily to the product or service your customers receive from you. It does not provide future opportunities for growth or innovation, and your competitors have to do it just as often as you do. There’s nothing proprietary about the task. These all factor into its low placement on the core competencies chart. Outsourcing book-close allows you to reinvest the time you currently spend on the tedium of transactional work into tasks that will add value to your company and its mission.

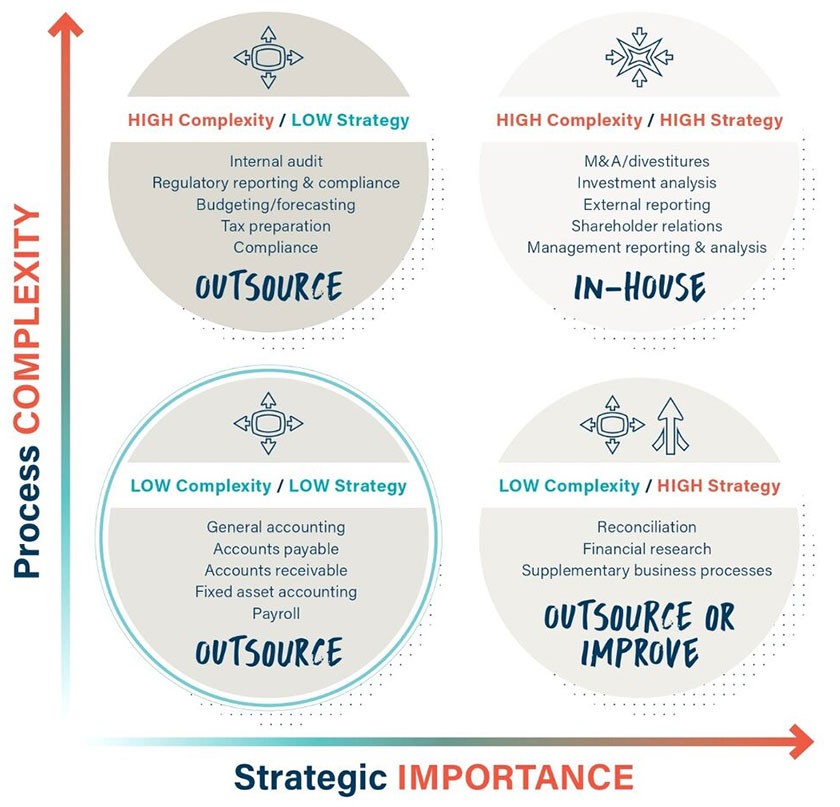

THE OUTSOURCING IMPLEMENTATION DECISION MATRIX

While some items or tasks are clearly peripheral or obviously critical, the rest are likelier to fall onto a spectrum. What about items that don’t provide future opportunities for growth but are difficult to for competitors to imitate? This is where a decision matrix can be helpful. Paul Harmon is a management consultant and business analyst who created the process-strategy matrix, an invaluable tool in determining which processes are best handled in-house and which ones can be effectively outsourced or in some cases, automated.

The strategic importance of a process is measured along the X-axis.

Strategic importance: To determine the strategic importance of a process, ask what the effect on key stakeholders – customers or executive leadership, for example — would be if the process were abandoned. The more significant the impact, the higher the strategic importance of the process.

The complexity of a process is measured along the Y-axis.

Process Complexity: How difficult is the process in question? Does it require a specialized set of skills or a professional certification? If the answer is yes, it belongs on the higher end of the complexity spectrum.

[High complexity/low strategy]

Internal audit

Regulatory reporting & compliance

Budgeting/forecasting

Tax preparation

Compliance

[High complexity/high strategy]

M&A/divestitures

Investment analysis

External reporting

Shareholder relations

Management reporting & analysis

[Low complexity/low strategy]

General accounting

Accounts payable

Accounts receivable

Fixed asset accounting

Payroll

[Low complexity/high strategy]

Reconciliation/Controller tasks

Financial research

Supplementary business processes

About Personiv: For over three decades, Personiv has been the partner businesses trust to develop and implement customized Finance and Accounting Outsourcing solutions. We provide flexible, scalable people-powered solutions that can deliver high-impact, high-quality results at half the cost.

With our flexible outsourcing implementation options and forward thinking solutions you can stop rushing to meet deadlines and instead focus on actionable data to grow your business. Personiv’s Finance & Accounting Solutions can take you from a backward-looking model to a cloud-based, data-driven approach – that gets results.

REAL-TIME REPORTING

TECHNOLOGY AGNOSTIC

S.-BASED ACCOUNT MANAGEMENT

ISO AND PCI CERTIFICATION

EDUCATED, EXPERIENCED TALENT

Get full access to the interactive tool.

WITH PERSONIV PERFORMING YOUR BUSINESS PROCESSES

YOU CAN ENJOY IMMEDIATE RESULTS PREPARED ON-DEMAND AT A PRICE POINT THAT TRADITIONAL OUTSOURCING CANNOT MATCH.